The first article of the series has introduced the Carbonate Triangle of the renowned Canadian oil sands. The region is the world's third largest oil reserve with its rich carbonate-hosted bitumen deposit located in the northern Alberta's deep underground. Precisely, the Carbonate Triangle is situated between three major bitumen areas, Athabasca, Cold Lake and Peace River.

Source: ERCB

In today's investment guide on the Carbonate Triangle, I will review briefly the main characteristics of the Athabasca area with the objective to provide the most complete information available to potential investors before deciding to seize the opportunity that the 54,132 square miles of the Carbonate Triangle has to offer.

So far, I looked into several producers involved in Peace River and Cold Lake regions of the Carbonate Triangle:

Peace River's most notable producers:

- PennWest Exploration (PWE), see article here.

- Royal Dutch Shell (RDS.A), see article here.

- Baytex (BTE), see article here.

- Strata Oil and Gas (SOIGF.PK), see article here.

- Petrobank Energy & Resources (PBEGF.PK), see article here.

Cold Lake's most notable producers:

- Husky Energy (HUSK.PK), see article here.

- Pengrowth Energy Corporation (PGH), see article here.

- Southern Pacific Resource (STPJF.PK), see article here.

- Canadian Natural Resources (CNQ), see article here.

- Devon Energy (DVN), see article here.

- Imperial Oil (IMO), see article here.

- Baytex, see article here.

- Bonavista Energy (BNPUF.PK), see article here.

Athabasca's most notable producers:

- Suncor Energy (SU) (Part 1), see article here.

- Suncor Energy (Part 2), see article here.

Let's start by reviewing briefly Athabasca, a famous and most prolific region in the Canadian oil sands as well as one of the largest reserve in the world.

Athabasca Region

Source: ERCB

The Athabasca oil sands are named after the Athabasca River which cuts through the heart of the deposit, and traces of the heavy oil are readily observed on the river banks. Commercial production of oil from the Athabasca oil sands began in 1967, when Great Canadian Oil Sands Limited, now incorporated into an independent company known as Suncor Energy, opened its first mine, producing 30,000Bls/d of synthetic crude oil.

The Athabasca region can be defined with two major oil sands deposits: the Grosmont Formation and the Wabiskaw-McMurray Formation. The Grosmont Formation is a late-Devonian shallow marine to peritidal platform carbonate consisting of four recognizable units within the deposit. All of the hydrocarbons are located in an updip position, structurally trapped along the erosional edge and contained by the overlying Clearwater Formation.

Source: ERCB

The McMurray Formation was deposited on an exposed karstic landscape of ridges and valleys and varies in thickness from being absent over Devonian highs to over 426 feet thick in the Bitumont Basin. Bitumen-rich reservoirs formed within estuarine valleys stacked above the Lower McMurray channel sands and are assigned to the Upper McMurray Formation.

Source: ERCB

The Athabasca region is estimated to hold total reserves of 1.34 trillion barrels of oil. Approximately 8-10% would be recoverable with current technology, which would represent a total reserve of 134 billion barrels. Compared to the estimated 7 billion barrels contained in Peace River and approximately 16 billion barrels in Cold Lake, the Athabasca region is the most prolific and the most promising of the three, located in the Carbonate Triangle.

Athabasca Oil (ATHOF.PK)

Founded in 2006, the company based in Alberta, acquired 215,000 acres, focusing on the sustainable development of oil sands in the Athabasca region and light oil resources in northwestern Alberta, Canada. By the end of 2007, Athabasca significantly expanded its land position by obtaining an additional 400,000 acres of oil sands leases in the Athabasca region. As a result, Athabasca held over 650,000 acres of oil sands leases in just over a year of operations. At the time, the best case resource potential estimated by a third-party, totaled up to 6 billion barrels of recoverable bitumen.

In 2008, Athabasca acquired additional land to reach 1.7 million acres of oil sands leases in the Athabasca region, increasing its best case reserve estimates to 6.9 billion barrels of contingent resources. In Q4 of 2009, Athabasca submitted a regulatory application for the first commercial phase of the MacKay River thermal oil project. The best case reserve estimates increased by 50% to 10.3 billion barrels of contingent resources.

In February 2010, the producer completed the sale of a 60% working interest in two oil sands projects, Dover and MacKay River for gross proceeds of $1.9 billion. In April 2010, Athabasca went public on the Public Stock Exchange raising $1.3 billion in gross proceeds. In November 2010, it acquired Excelsior Energy for $133 million. The strategic acquisition brought the Hangingstone asset to a commercial size for development.

In the second half of 2010, Athabasca acquired over one million acres of conventional oil and natural gas rights, targeting numerous mineral formations including Nordegg, Montney Duvernay in the deep basin. Athabasca finished the year holding over 2.5 million acres in oil sands and P&NG leases in the deep basin and Athabasca regions of northern Alberta. In December 2010, the joint venture between Athabasca and PetroChina (PTR) submitted a regulatory application for a 50,000Bls/d thermal oil project at Dover.

2011 was a busy year for the company. In March, it filed a regulatory application for a 12,000Bls/d project which will be the first phase of the Hangingstone thermal oil development. Athabasca acquired an additional working interest in Hangingstone in September 2011, amounting to 24,640 acres. A month later, the producer filed a regulatory application for a 6,000Bls/d TAGD demonstration project in the Dover West Leduc Carbonate Formation. By the end of 2011, Athabasca held over 3.5 million net acres of oil leases in the deep basin and Athabasca regions of northern Alberta.

Source: Athabasca Oil

In May 2012, the company changed its name from Athabasca Oil Sands Corp. to Athabasca Oil Corporation to better reflect the 50/50 targets of the company between the two divisions of light oil and thermal oil. It also sold its 40% interest in MacKay for a purchase price of $680 million. By the end of 2012, the company was holding more than 4.3 million net acres of land in Alberta.

A Strategy Based On Synergies

Athabasca has matured a growth strategy encompassing the synergies of long lived oil sands projects with a high return light oil and liquids rich gas development.

The producer is fully funded for all wholly owned thermal oil projects filed and its light oil program from cash on hand, cash from operations, a reasonable level of debt and, anticipated proceeds from the Dover put/call option. Athabasca's strategic vision is to produce 220,000Boe/d by the year 2020, with half from the Thermal Oil Division and half from the Light Oil Division.

Two Divisions For The Utmost Versatility

Source: Athabasca Oil

Thermal Oil Division

Over 1.5 million net acres of leases in the Athabasca area

First commercial production is expected in 2014

Five projects with over 9.2 billion barrels of contingent resources

Promising projects of Hangingstone (100%), Dover West (100%), Dover (40%), Birch(100%) and Grosmont (50%)

In-situ recovery methods including SAGD and TAGD

Oil sands development targets include bitumen in the stacked Wabiskaw and McMurray formations as well as bitumen in the carbonates of the Leduc and Grosmont formations. The best estimate of the contingent bitumen resources has increased in the Thermal Oil Division, year-over-year by approximately 8% to 10.6 billion barrels. At year-end, Athabasca had 342Mmbls (million barrels) of proved plus probable bitumen reserves.

The acquisition of the drilling, core and seismic data acquired during the winter of 2011-2012 has enhanced the company's geological and geophysical understanding of the complex subsurface depositional environments, further delineating Athabasca's abundant bitumen resources. Data obtained during the winter drilling and seismic programs were analyzed by independent engineers, increasing Athabasca's year-over-year bitumen reserves and contingent resources.

Development work continued during 2012 to unlock the vast bitumen potential of Athabasca's carbonate plays. The company conducted two "proof of concept" TAGD field tests at Dover West, effectively heating the carbonate reservoir and mobilizing bitumen to a production well. Near Strathmore, Alberta, Athabasca commenced the construction of the Heater Assembly Facility where the TAGD downhole heater prototype was tested.

Hangingstone Project

Source: Athabasca Oil

The Hangingstone Phase 1, a 12,000Bls/d SAGD operation, is located approximately 12 miles southwest of Fort McMurray and includes 136,000 net acres of land. In October 2012, Athabasca received approvals from the Government of Alberta to construct Phase 1, its first wholly-owned SAGD project.

In late November 2012, Athabasca sanctioned the project's capital budget of $536 million and an additional $27 million for the construction of supporting infrastructure. Based upon an independent engineering estimate at the end of 2012, Hangingstone would contain 51Mmbls of proved reserves, 66Mmbls of probable reserves and the best estimate of the contingent resources would be approximately 0.9Bbls (billion barrels).

The FEED (front-end engineering and design) process for the Hangingstone Phase 1 was completed in 2012. Athabasca had contractually committed more than 60% of the forecasted capital expenditures, including the procurement of long-lead equipment such as the boilers, evaporators, pumps, two SAGD drilling rigs and one SAGD completions rig. Detailed engineering for the project is now 83% complete. First steam is targeted for late 2014.

(click to enlarge)

Source: Athabasca Oil

The Hangingstone Phase 1 is intended to be followed by two consecutive SAGD projects, bringing the area's overall production to more than 80,000Bls/d. In 2012, Athabasca designed the full-asset life cycle development plan for the Hangingstone Phases 2 and 3, including the required expansions to the central processing plant and the well pad layouts.

In support of this full-asset life cycle development plan, the company gathered environmental data to support regulatory submissions for these commercial SAGD projects. Athabasca drilled 23 appraisal wells at its Phase 2 in Q1 of 2013 to further delineate bitumen resources. Phase 2 is expected to ramp-up in 2017 while Phase 3 should be commissioned for 2019.

Dover West Project

Source: Athabasca Oil

Production from the company's bitumen-rich Leduc Formation, originally formed as a coral reef and characterized today by excellent porosity and permeability, is expected to utilize the TAGD process, an innovative production technology employing downhole conduction heaters.

In 2012, Athabasca's "proof of concept" field tests delivered all of its objectives, confirming that the TAGD production technology could effectively heat the reservoir and mobilize bitumen to a production well, and paving the way to launching the TAGD Pilot/Demonstration Project.

Two TAGD production phases were conducted at Dover West during 2012, the technology successfully mobilized bitumen at lower temperatures than those utilized in the SAGD production process. During these production phases, bitumen was mobilized at an estimated 70-90?C, and 60% to 70% of the bitumen heated to greater than 80?C was recovered. The conduction heating cables were fully operational throughout the field tests. Data obtained during the field tests have enabled Athabasca to model the deployment of this innovative production technology, simulating the production performance of a commercial TAGD project.

Source: Athabasca Oil

Furthermore, during last year, Athabasca commenced construction of its HAF (Heater Assembly Facility) near Strathmore. The company drilled a horizontal and a vertical well at the HAF and assembled a downhole heater prototype for the TAGD Pilot/Demonstration Project. Engineering and development plans progressed during 2012, and the regulatory approval process for the TAGD Pilot/Demonstration Project moved forward. Athabasca anticipates receiving regulatory approvals in the next few months. Phase 1 is expected to ramp-up in 2015 with a capacity of 6,000Bls/d while Phase 2 is expected to have the same capacity but commissioning has not been determined yet.

At the end of last year, it was estimated that Athabasca's Leduc carbonate trend contained approximately 16.7Bbls of petroleum initially in place, of which 11.6Bbls are discovered, and the best estimate of the contingent resources would be approximately 3Bbls.

In the first nine months of 2012, Athabasca acquired approximately 30,000 acres of oil sands leases contiguous to its existing Dover West assets. Regulatory approval and internal sanction for the first 12,000-barrel-per-day phase are expected in 2013 with commissioning in 2015. Four additional phases with a capacity of 140,000 barrels per day are expected to ramp-up between 2018 and 2024. The company said that its Dover West project could now eventually support development up to 270,000 barrels per day. The producer estimated at 87Mmbls of probable reserves and the best estimate of the contingent resources would be approximately 2.9Bbls, as of December 2012.

Birch Project

Source: Athabasca Oil

Birch is characterized by its 470,000 net acres, located about 59 miles northwest of Fort McMurray. Athabasca's 2011-2012 winter drilling program included 22 delineation wells at Birch and 23 water source and disposal wells across Hangingstone, Birch and Dover West. The winter drilling program was completed on time and under budget, with $28.9 million spent at Birch in the first nine months of 2012. The company's 2011-2012 winter seismic program consisted of 33.5 miles of 3-D seismic data in the Birch area.

The new drilling, core and seismic data have been integrated, enhancing the producer's geological and geophysical understanding of the complex subsurface depositional environments, further delineating Athabasca's abundant bitumen resources. As of the end of 2012, the company estimated that the best estimate of the contingent resources would be approximately 2.1Bbls for its Birch project.

Grosmont Carbonates Joint Venture Project

Source: Athabasca Oil

Athabasca has a 50/50 joint venture with ZAM Ventures Alberta in an emerging thermal oil play in northern Alberta. The carbonate rocks of Alberta's Grosmont Formation and the overlying Nisku Formation contain more than 380 billion barrels of undiscovered petroleum initially in place. Although production from the Grosmont Formation has yet to be commercially developed, the oil and gas industry is devoting significant resources to unlocking its vast resource potential.

The project counts 394,000 net acres, located approximately 115 miles north of Slave Lake and the company is projecting to utilize the TAGD process to recover bitumen from that specific oil play. As of December 2012, Athabasca estimated that the best estimate of the contingent resources would be approximately 0.8Bbls, representing 0.4Bbls of the company's working interest.

Dover Joint Venture Project

Source: Athabasca Oil

In 2012, Athabasca invested $8 million at Dover, an oil sands joint venture operated by Dover Operating Corp., a company jointly owned by Athabasca at 40% interests and Phoenix Energy Holdings at 60% interests, successor by amalgamation to Cretaceous Oilsands Holdings, a wholly-owned subsidiary of PetroChina. The joint venture counts approximately 60,000 net acres of land.

Source: Athabasca Oil

In April 2013, a regulatory hearing commenced for the Dover SAGD commercial project, a 250,000Bls/d comprised of five 50,000Bls/d phases that would be commissioned between 2016 and 2024. Dover anticipates receiving regulatory approvals later this year. Notably, receipt of provincial regulatory approvals would allow Athabasca to exercise the put option for proceeds of $1.32 billion dollars to the company. As of December 2012, the best estimate of the contingent resources for Dover, would be approximately 3 billion barrels, representing 1.2 billion barrels of the company's working interest.

The following chart depicts a recap of the development schedule for some of its thermal oil projects.

Source: Athabasca Oil

Light Oil Division

Source: Athabasca Oil

Over 2 million net acres of leases in northwestern Alberta

Between 8,000-10,000Boe/d in 2012 production output

Initial development areas include Kaybob, Simonette and Grande Prairie

Horizontal drilling and multi-stage hydraulic fracturing technology

Athabasca is targeting its production of light oil and natural gas with associated natural gas liquids to ramp-up to between 100,000Boe/d and 130,000Boe/d by 2020. Athabasca has over 2.7 million acres of petroleum and natural gas rights situated within several prolific geological trends in the province of Alberta. It has strategically positioned its land holdings to target oil and liquids-rich natural gas development in the Montney, Duvernay, Nordegg and Charlie Lake formations.

Source: Athabasca Oil

Consistent with current industry practices, these unconventional resources will be developed utilizing horizontal drilling and multi-stage fracturing technologies. Characterized by multiple stacked hydrocarbon-bearing zones, the development of these assets involves drilling multiple horizontal wells from common surface facilities. Athabasca is focused on efficiently developing its light oil assets, and in delivering value to its shareholders by achieving lower development and operational costs.

Source: Athabasca Oil

First light oil production commenced in late 2011. Athabasca completed the tie-in of three batteries during Q4 of 2012, for an expected exit rate of 10,000-11,000Boe/d. A mid-year review of the company's drilling, completion and testing program, effective in April 2012, resulted in an increase in the Light Oil Division's total proved plus probable reserves to 20Mmboe, comprised of 45% oil and NGLs.

Athabasca's 2012 multi-well drilling program tested the prospectivity of the Montney, Duvernay and Charlie lake formations utilizing horizontal drilling and multi-stage fracture technology. The company drilled 14 wells in the first quarter and completed 16 wells. Results of the Q1 2012 drilling program are excellent, highlighted by the discovery of a potentially prolific Duvernay oil pool at the company's Kaybob property.

Source: Athabasca Oil

During Q2 of 2012, Athabasca conducted multi-stage hydraulic fracture completions on one Montney and one Nordegg well, both with successful results. The Kaybob East horizontal Montney well was flow tested for 72 hours, producing at a final stabilized rate of approximately 965Boe/d (20% oil) at a flowing pressure of 12,500 kPag, reaffirming the presence of high quality Montney reservoir rock in Athabasca's Kaybob East area.

Also in Q2 of 2012, the company re-tested its previously announced Kaybob Duvernay horizontal oil well. The well was flowed for another 90 hours, achieving final stabilized rates of 800Boe/d at a flowing pressure of approximately 7,000 kPag. This production test result represents a significant increase in rates, 70% increase in oil rate, from the original test results and a tenfold increase in flowing pressure.

Given positive drilling and production testing results, Athabasca has increased the capacity of certain facilities and has accelerated infrastructure construction, adding $60 million to its 2012 light oil capital budget. Athabasca reported an operating netback in its light oil division at $33.08/Boe for Q1 of 2013 compared to $26.62/Boe for Q1 of 2012, according to its MD&A Q1 2013 release.

Financials At A Glance

Athabasca's revenue for Q1 2013 achieved $31.78 million, up from $8.61 million totaled at the same period last year. However, results in depreciation and depletion amounted at $21.75 million, a substantial increase from $4.54 million of last year. The company explains the $17.2 million increase primarily due to depletion charged on additional production from light oil assets compared with the same period in 2012. Moreover, in Q4 of 2012, Athabasca also began recognizing depreciation on supporting infrastructure assets once they became ready for use. Thus, the company suffered a net loss of $25.49 million in the quarter compared to a loss of $19.69 million amounted at the same period last year.

The company spent $83.80 million in capex for its thermal projects in Q1 of 2013 compared to a steeper amount of $185.69 million injected at the same period last year. For its Light Oil Division, the capex totaled $175.96 million, down from $222.26 million achieved in Q1 of 2012. Total capex allocated for Q1 of 2013 totaled $264.36 million, down 35.6% from $410.76 million in Q1 2012.

Athabasca believes it will fund its activities beyond 2013 through a combination of cash flow from operations, the potential exercise of the Dover put-call options, a reasonable level of debt and further joint ventures. The long-term debt of the producer totaled $530 million in Q1 of 2013, a slight increase from $529 million of Q4 2012.

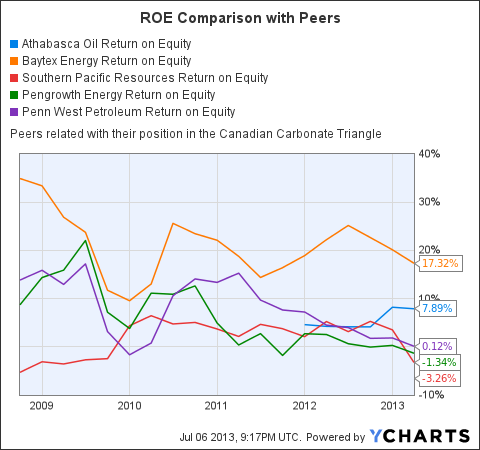

The company is financially in good health, its long-term debt to equity ratio equaling a low 15.39 compared to its industry's average of 65.54. Furthermore, its return on equity attests of the management's effectiveness to sustain and create profitability with the shareholders money, its TTM ROE ratio being at 7.72%, higher than the industry's average of 6.06%.

Even more appealing, Athabasca's ROE 5-year average's ratio remains at 32.25% compared to 7.62% for its industry, a stronger assessment of the efficiency in that department.

Bottom Line

Athabasca represents a great opportunity for investors interested in getting involved in the Canadian oil sands of Alberta. Here are the most significant upsides identified:

- More than 4.3 million net acres of land leased in the Canadian oil sands

- Five thermal projects with over 9.2 billion barrels of contingent resources and about 70,000Bls/d of production achievable by 2016

- A production target of light oil and natural gas to ramp-up to between 100,000Boe/d and 130,000Boe/d by 2020

- Very low long-term debt adds strong flexibility to pursue projects development and new opportunities

- Strong efficiency to maximize profitability

- Significant potential for growth of share value within two or three years

However, here are the potential risks that stand out:

- Substantial and prolonged drop in the price of crude oil would put pressure on earnings and cash flow of the company

- Pursuit of several projects at a time for a small-cap producer could impact its financial health in the long run

- Operating costs estimates for its thermal projects are still unknown

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

lunar eclipse Sunil Tripathi Tavon Austin Ella Fitzgerald Kenny Vaccaro Kate McKinnon gwyneth paltrow

কোন মন্তব্য নেই:

একটি মন্তব্য পোস্ট করুন